One of the things that we’ve learned over the past two years is that the job market is not nearly as stable as we thought it was. The acute impact of the COVID-19 pandemic caused a global slowdown of economic growth and a significant spike in risk aversion from all corners of the labor market. Combine this with the inflation created by the widespread printing of relief money, and we’re in a position now where the job market has taken quite a hit.

Research from Goldman Sachs suggests that the slowing economy will cause a big hit on job growth, with the unemployment rate likely to rise to around 3.8% at the end of 2023 and then to 4% by the end of 2024. This will cause ripple effects throughout all industries as companies reign in their hiring in an attempt to manage higher interest rates and lower consumer confidence. But some sectors are going to be hit harder than most, and one of those is commercial (CDL) drivers–who remain the heart of our global supply chain.

In this article, we want to explore what the outlook is for these drivers (and the companies that hire them) in 2023 and beyond to get a sense of how best to move forward in these rather uncertain times.

Supply Chain Impacts

Over the past hundred years, the world has embarked on a dramatic period of globalization where we built complex country-agnostic supply chains that encouraged specialization and provided lots of cost-saving opportunities. This created a need for complex transportation networks to move goods through the value chain and to their final customer, all of which necessitated commercial drivers at various stages along the way. The pandemic threw a huge spanner into this and radically disrupted the supply chains as we knew them, forcing companies to re-assess how robust their procurement solutions actually were to black swan events.

While things have normalized somewhat, supply chains still face challenges in terms of returning to normal operations, and many have turned to a more decentralized strategy going forward to try and insulate them from the pain they’ve experienced recently. This is bad news for truckers specifically who rely on long-haul trips to make their money and may feel the pinch here. The good news is that there is the offsetting nature of the continued growth of e-commerce which grows the industry. What we might see in the near future is a shift to a different type of commercial driving that maintains the number of jobs, or at least minimizes the impact of the supply chain struggles we’ve seen.

The Recession

The other major economic impact that we’re experiencing is a recession that could last for a number of years and create further stress on an economy that is still trying to get back on its feet. As companies prepare for the turbulent times ahead, we’re likely to see the transportation industry struggle to employ drivers at anywhere close to the levels that we saw during the 2010 – 2020 bull cycle.

A constrained labor market has forced significant wage inflation, and this will continue to warp the prospects of trucking and transport more generally as they try to maintain margins.

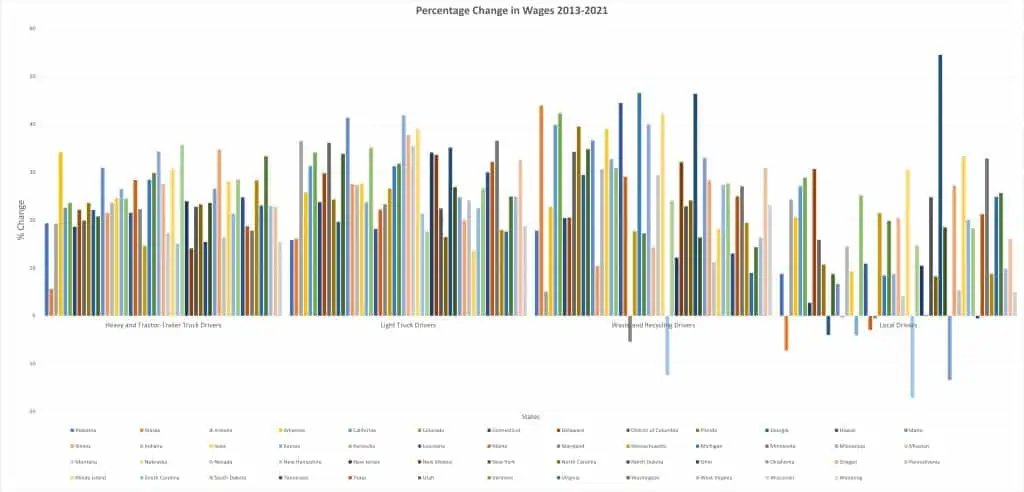

Looking back over 2013-2021 in the graph below, you can see the effects the most recent bull cycle has had on wages. The vast majority of states have seen significant wage increases across all major trucking industries.

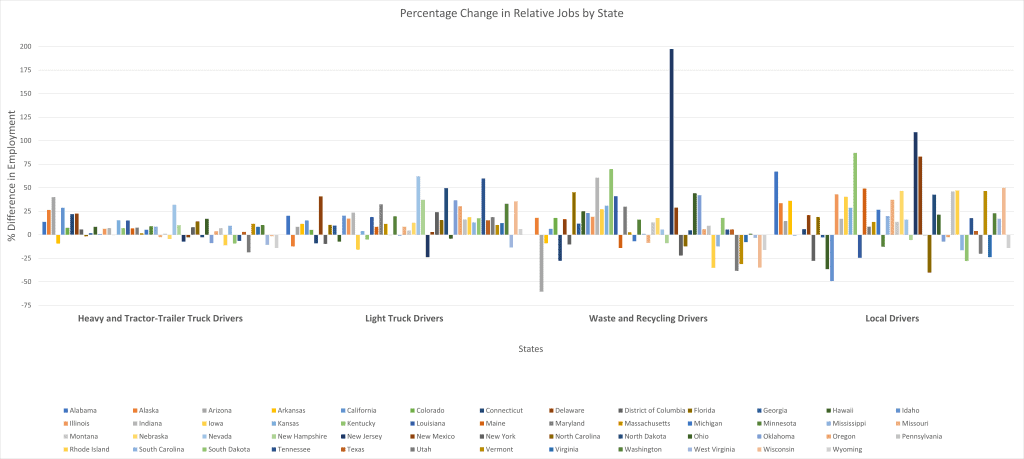

It is important to realize that inflation will impact each state separately. Looking at data from 2019-2021, Percentage Change in Relative CDL Driver Jobs by State, we see some states have added a significant amount of trucking jobs. These states are much more likely to struggle with hiring in the years to come than those states that are lowering their stake in trucking industries.

Another key factor (aided by the recession) is that the average age of truckers is rising sharply, and we’re not seeing enough of Generation Z coming into the workforce from the bottom. The labor participation rate for people from age 20-24 has had its steepest drop in 74 years, and while that allows older drivers to hold onto their jobs for longer, it doesn’t allow for the natural churn in the labor market which makes for a sustainable base of potential hires. As such, hiring truckers and drivers in 2023 and beyond is likely to be more challenging than it has been in a while.

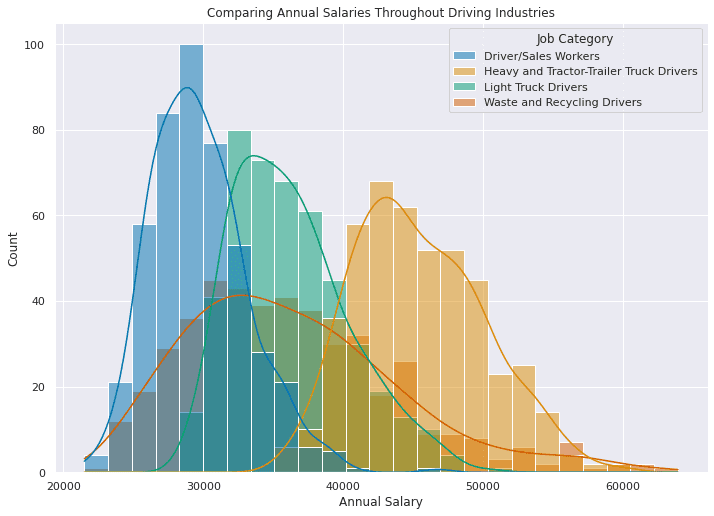

The Comparing Annual Salaries Throughout Driver Industries (2019-2021) graph below gives a nice example of the “spread of the wages”. We can see from the graph that:

- The local driver industry has most employees earning around $30,000 per year

on average over 2019-2021 - The waste and recycling industry averages $37,000 per year with a second peak

around the $57,000 range - Light truck drivers earn around $39,000, and heavy truck drivers earn $50,000 on average.

- We can see that all of the categories have lower spreads (lower standard deviations) than the waste and recycling industry, indicating that the wages for this industry are much more state-dependent.

Build Back Better

The final factor we’re going to explore is the impact of Joe Biden’s ‘Build Back Better’ plan if it comes to pass. Initial estimations suggest that this widespread economic reform will create 2.3 million jobs per year in the first five years – most of which are expected to be long-term and sustainable in nature. While the majority of these are in childcare, Universal pre-k, and long-term care – there are good tailwinds in terms of construction, manufacturing, and supply chain which could help to reinvigorate the CDL driving labor market to some extent.

The overall sentiment of the plan is an attempt to bring manufacturing and many other primary industries back onto American shores to insulate against the risks of globalization and promote local growth as a result. This is an objective that bodes well for American drivers, and while it remains to be seen how this will play out, the potential here is significant.

What Does This Mean For Hiring?

We’re heading into a difficult labor market that is going to significantly increase the competition for jobs and force companies to be much more strategic and efficient with their recruitment processes. Here at Inflection Poynt, we have had success in even some of the toughest markets helping clients source top talent through our smart-sourcing marketing engine and data-driven, skill-based hiring solutions.

We are passionate about helping the trucking, transportation, and logistics industries hire CDL drivers that can take your company’s operations to the next level, especially with the tough labor market ahead. If you’d like to explore how we can help, get in touch today! We’d love to hear from you.